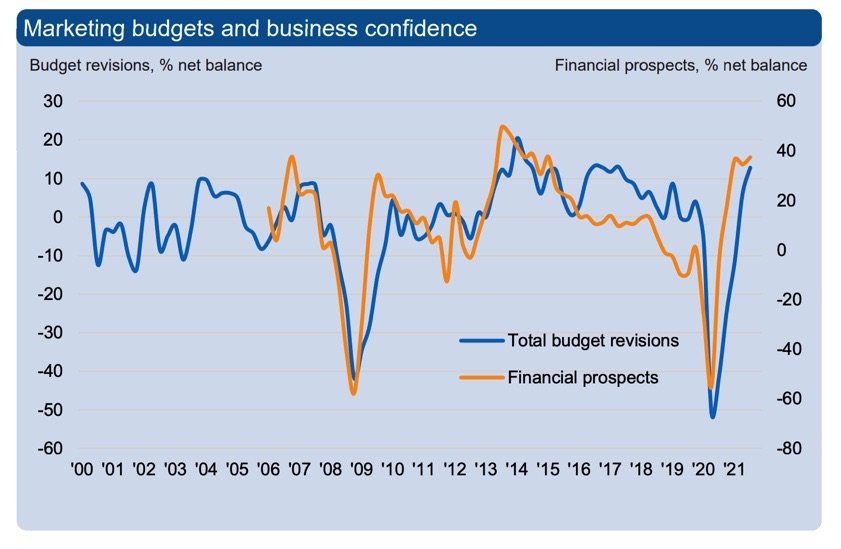

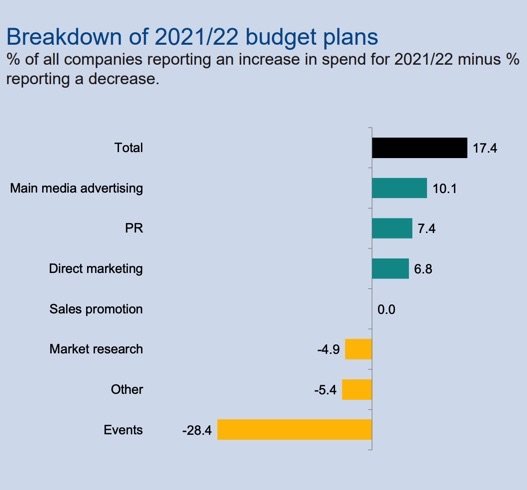

This week’s IPA Bellwether report confirmed that marketing budgets are soaring post lockdown, propelled by online video. Amid this renewed optimism, the PMW team assembled 20 leaders in the UK performance marketing industry to hear their take on the year ahead.

The IPA Bellwether Report, covered in PMW yesterday, indicated that UK ad budgets are now growing at the strongest rate since 2017. This was driven by pent-up consumer demand, a successful vaccination roll-out and looser restrictions.

Even more encouragingly, company-level financial prospects are at their most optimistic since 2015, and ad spend is set to grow further in 2022.

But clouds are appearing on the horizon. Some surveyed companies were wary of lingering uncertainties, particularly around the

trajectory of virus cases as we head into the winter period. Ongoing supply chain disruptions, which some firms mentioned had impacted their ability to carry out marketing campaigns, were also cited as a downside risk.

Lockdown savings versus skills gaps: Marketers identify pros and cons of post pandemic UK

IPA Bellwether panellists were asked to comment on the main opportunities and threats for their industries over the coming 12 months.

A selection of responses are summarised below:

Opportunities

"More normal consumer spending habits." Financial Services

"Brexit can be pushing companies to look for further, unexplored opportunities in the UK." Media/Marketing

"Climate change - more people trading gas products for electric ones." Consumer Durables

"Economic recovery will provide a more stable operating environment." Automotive

"Continued shift towards green infrastructure development." Industrial/ Utilities

"Effectiveness and pace of the vaccine roll-out." Media/Marketing

"Consumers spending their savings post-pandemic." Retail

"Re-opening of hospitality will restore food service business." FMCG

"Sustainability, digital marketing and online sales growth." Consumer Durables

"New house building planned in the government's 'levelling up' agenda." Industrial/Utilities

"A shift towards digital and e-commerce trading." Media/Marketing

"Return of furloughed workers." Automotive

"Sales growth back to pre-pandemic levels." FMCG

"Sales promotions and events as containment rules relax and businesses re-open." Consumer Durables

"Huge growth in digital transformation needs." IT/Computing

Threats

"People putting off investment into IT projects given the increasing uncertainty in the economic environment." IT/Computing

"Reduced availability of candidates for operational roles leading to inability to expand." Automotive

"Material shortages and rising prices of raw materials." Consumer Durables

"COVID-19 outbreaks could reduce business." Financial Services

"Brexit continues to place adverse pressure on business with the EU." Industrial/Utilities

"Another major downturn due to COVID-19 or weaker China growth would put global growth under pressure." Media/Marketing

"Freight shortages leading to difficulty in getting the product to the stores in time." Retail

"Brexit continues to add complexity and adds friction to trade with EU." FMCG

"Inflation, component supply, transport issues, labour shortages." Industrial/Utilities

"Economic uncertainty. Slow down in the housing market." Consumer Durables

"Larger brands focusing on cost-cutting. Brands are still cautious to spend due to uncertainty around future lockdowns." Media/Marketing

"Continuation of global pandemic and variants resistant to vaccines, leading to further restrictions in travel." Travel/Entertainment

"Budget cuts, greater competition, new digital competitors." Public/ Charities

Industry reaction

Following the report, Performance Marketing World reached out to key industry leaders for their key takeaways from the report.

“More creative and engaging formats, such as video and social, will become increasingly important in grabbing audience attention.”

Lucy Hinton, Head of Client Operations, Flashtalking by Mediaocean:

“With a net balance of +12.8% of companies reporting increase in ad spend, the future certainly looks bright for the industry as it aims to get back to pre-pandemic levels. As we enter the key seasonal shopping period, we will get our clearest view yet of these new online habits. With the added incentives of consumers having more savings, wanting to make the most of the end of lockdown restrictions, and planning ahead to avoid threatened shortages, it is a critical time for marketers to really tune in to what their audience is doing and adjust their strategies in response.

“More creative and engaging formats, such as video and social, will become increasingly important in grabbing audience attention. With the explosive success of TikTok in the past year and the continued high engagement levels of Instagram and Facebook, paired with the tools available to produce novel, eye-catching campaigns, these are instrumental platforms to be included in marketing programmes.”

See the full IPA Bellwether Report here.

About the IPA Bellwether Report

The IPA Bellwether Report is a quarterly survey outlining companies’ marketing spend intentions and financial confidence. The Bellwether Report is researched and published by IHS Markit on behalf of the Institute of Practitioners in Advertising. The report features original data drawn from a panel of around 300 UK marketing professionals and provides a key indicator of the health of the economy. The survey panel has been carefully selected to represent all key business sectors, drawn primarily from the nation’s top 1000 companies.